Should I buy an NRAS Property

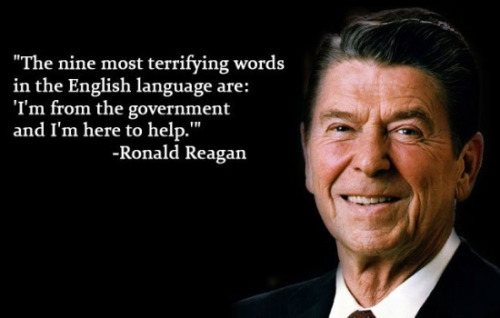

The nine most terrifying words in the English language are, ‘I’m from the government and I’m here to help.’ according to Ronald Reagan, the fortieth president of the USA. And he should know, since he helped a bunch of mujahideen in Afghanistan with Stinger missiles and other paraphernalia of war in Operation Cyclone. That worked out well for everyone…

Which brings me to the National Rental Affordability Scheme (NRAS) which commenced on 1 July 2008 with the legislated aim to “encourage large‑scale investment in housing by offering an incentive to participants in the National Rental Affordability Scheme so as to:

(a) increase the supply of affordable rental dwellings; and

(b) reduce rental costs for low and moderate income households.”

I like how the Department of Social Services refers to the NRAS in short as “the Scheme”, evoking memories of other schemes. Remember the Home Insulation Scheme? Who could forget the flood of newly-minted installers chasing the government cash, the four deaths from electrocution, the shonky installations and outright fraud, the abrupt termination of the scheme, the compensation fund and finally the Royal Commission. What a bumpy ride but at least some people got a softly-padded landing.

So let’s take a look at the latest Scheme to Make Rental Properties Great Again. Did you notice that the Australian Government administering this scheme is the Department of Social Services (DSS)? Yes landlords of Australia, with NRAS you are going onto Centrelink benefits. Seriously. Those of you who own low-income housing are probably thinking “Well it cuts out the middle-man!”. Jokes aside, what is the issue here?

You are entering a world of regulated income. Of rent by decree. That can change with the stroke of a pen. Which it did. The Government announced in the Budget on 13 May 2014 that it would not proceed with Round 5 of NRAS, announcing “The money that was set aside for Round 5 will be returned to the Budget and contribute to Australia’s savings”. Did you notice the return of those savings? Same here…

So why would anyone invest in an NRAS property? To receive the NRAS incentive payment of course. The NRAS incentive is an annual amount, indexed annually provided to approved participants for each approved dwelling which complies with the conditions of the allocation of incentive for the dwelling. The incentive comprises:

- An Australian Government contribution per dwelling per year for up to 10 years as a tax offset.

- State and Territory Governments may offer approved participants a contribution per dwelling per year as direct payment or payment in-kind.

I have put in bold the key words I would like you to focus on – complies, and may offer. In other words, if circumstances change, your property may not comply, and you could lose your incentive payment. For example, your tenant may get a pay rise and no longer qualify for NRAS assistance. Which could certainly lead to a preserve incentive for tenants to keep their income below the prescribed limits, or alternatively earn income in ways that do not pass through the normal reporting systems.

Speaking of tenants, as a newly-minted NRAS owner you will be targeting low income tenants. The income limits are generous, for example in 2016/17 a sole parent with two children can earn up to $83,233 and still qualify. Yet NRAS properties are not built in isolation, but rather in large group developments. So you will be grouping together large numbers of low-income tenants. This strategy has not worked well for Government housing departments around Australia, many of whom have abandoned the concentration model and now disbursed their tenants around the suburbs. For example in Western Australia the awarded New Living program “aims to reduce high concentrations of public housing…”.

The NRAS has also created a high concentration of financial advisers, promoters and salespeople eager to cash in on investor interest in the Scheme. As fellow schemers, they will waive the shiny incentive payments before your eyes and seek to entice you to buy their newly-developed properties. And like other Schemes, fraudsters abound, so much so that the DSS has issued formal warnings alerting investors about cold-callers promoting NRAS. Investors please take note – capital accumulates slowly from your hard labour, and can be burned very quickly by a wrong decision. Do your due diligence.

Take a step back and think for a moment. You are looking to buy property. Which is a long-term investment. The NRAS incentives will be all gone in 10 years (or earlier if the Scheme is cancelled). You will then be left with a decade-old home that has suffered the wear and tear of low-income tenants. In a cluster of properties all tenanted, with owners all thinking about selling at the same time.

So forget the fiscal favours and focus on fundamentals. Land appreciates and building depreciate. In general. In the long-term. Perhaps not in Perth 2016. So what should you buy?

As an investor you want your rental property surrounded by owner-occupier neighbours. And certainly not positioned in the centre of a large group development surrounded by other rental properties. When grouped investment properties are all chasing new tenants in a quiet rental market, the only way to differentiate a property is by price, so rents will be going one way, down.

My stock standard suggestion for investors is to buy an ordinary house on a potentially subdivisible block of land within a reasonable distance of the city centre. And only buy when you can afford to make the loan repayments and other holding costs. Without a tenant. For some time. If you budget on that, every rent payment is a bonus.

And when your property is tenanted for some time, and your bank balance is still rising, consider buying your next.

Many years down the track, develop your own properties. Then rent them out. To ordinary tenants. That’s my scheme.